Today I present the first of a series of Newsletter posts based on our report published yesterday on the impact of cost rental housing. The research, the first big study of the sector, was conducted with Cian O’Callaghan, Sarah Sheridan and Rob Sweeney, was funded by the Housing Agency (thanks!) and supported by the three largest AHBs (Clúid, Respond, Tuath – also thanks!). You can read more about the research design in the report, but the TLDR version is we surveyed 100 tenants and interviewed 28, from cost rental developments across the country. At the time of research (last summer), there were about 551 tenancies in the CR sector (now it’s about 1,700). At the end of this series, I will include some reflections from Threshold’s event, from last week, that brought together a range of stakeholders, experts and politicians to examine the Housing Commission’s proposal of increasing social/cost rental to 20% of housing stock. Note the findings are presented in a lot more detail in the full report. The next instalments focus on affordability, security/home and place. Here I introduce cost rental housing and present a profile of the sector. Also, I had an op-ed on Tuesday in the Irish Examiner analyzing Sinn Féin’s proposals for the PRS.

Introducing cost rental

Cost Rental housing is funded via borrowing from public sources.

· Cost Rental Equity Loan (CREL): this funding is provided by the Department of Housing and can cover up to 45% of costs. The loan term is 40 years, with a 1% interest rate. Its paid back at the end of the loan term.

· The Housing Finance Agency: the remaining funding is provided by the HFA, taking the form of a 40-year loan with a 3.75% fixed interest rate (currently) for the first 30 years, and a variable rate for the remaining ten.

Irish Cost Rental differs from its European counterparts with regard to funding arrangements. In Austria, Denmark and the Netherlands, Cost Rental housing is majority privately financed.

Under the terms of the Affordable Housing Act 2021, rents are set on the basis of the following costs, calculated over a 40 year period:

(i) Costs associated with making the dwelling available for rent including any capital development or acquisition costs involved;

(ii) Financing costs associated with making the dwelling available for rent including debt finance costs, interest charges and limited equity returns;

(iii) Necessary and appropriate management costs associated with the dwelling, including costs of letting the dwelling;

(iv) Costs associated with necessary and appropriate maintenance of the dwelling during the cost calculation period;

(v) Costs of maintaining a prudent contingency surplus in addition to a sinking fund created to meet projected maintenance costs associated with the dwelling during the cost calculation period.

Cost Rental policy also determines that Cost Rental initial rents must be 25% below comparable market rents. Under the current arrangements, any rent increases must not exceed the Harmonised Consumer Price Index. Currently, AHBs have either elected to keep rent increases at 2% (in line with the cap associated with private rents within Rent Pressure Zones) or have not implemented rent increases. Rents in the developments included in the present study were between approximately €1,000 and €1,400.

The rolling of out of Cost Rental in Ireland has coincided with an extraordinary period of cost inflation, due to interest rate and inflation increases. The operational costs of AHB Cost Rental providers, which represent a large part of overall costs and thus have a significant impact on rents, have increased by as much as 30%. Construction costs have of course also increased markedly.

Allocation is the most unusual feature of Irish Cost Rental, when compared to its European counterparts. As noted, the tenure is aimed at households whose income falls above the threshold for social housing (currently between €30,000 and €40,000) but for whom the private housing market is unaffordable. The upper income thresholds for Cost Rental eligibility are a net household income of €66,000 for Dublin and €59,000 for the rest of the country. In addition to the above income limits, the rent associated with a Cost Rental tenancy must be ‘affordable’ for a household to be eligible. This is defined as the rent being less than 35% of applicant households’ net income. However, this criterion can be waived where the applicant demonstrates they have been paying a similar or higher rent for the previous two years.

Stepping back from the design of Cost Rental housing in Ireland, it is useful to consider its nature and potential. This can be understood through the following lenses:

1. Cost Rental provides a form of secure, stable rental housing, with strong security of tenure arrangements, which previously was not available to any household who did not qualify for social housing.

2. A real alternative: given the above features, Cost Rental housing can provide an alternative to homeownership.

3. Affordability: as rents are not set via market mechanisms, but via policy decisions, Cost Rental housing can positively impact affordability in two senses. First of all, and most obviously, by reducing the housing costs of residents. Second of all, as an alternative to market housing a Cost Rental sector (assuming sufficient scale) increases the affordability of market housing by exercising a price dampening influence.

4. Supply: Cost Rental housing also offers Government an additional, and theoretically self-financing, mechanism through which to shape the supply of housing.

Profile of the sector

The most common household type within Cost Rental is 2-person households, and the vast majority are 2-4-person. The most common household composition is two adults with kids, followed by two adults without kids.

The mean adult age is 35.7 years, and the mean child age is 6.6 years. The vast majority of adults are in full time employment.

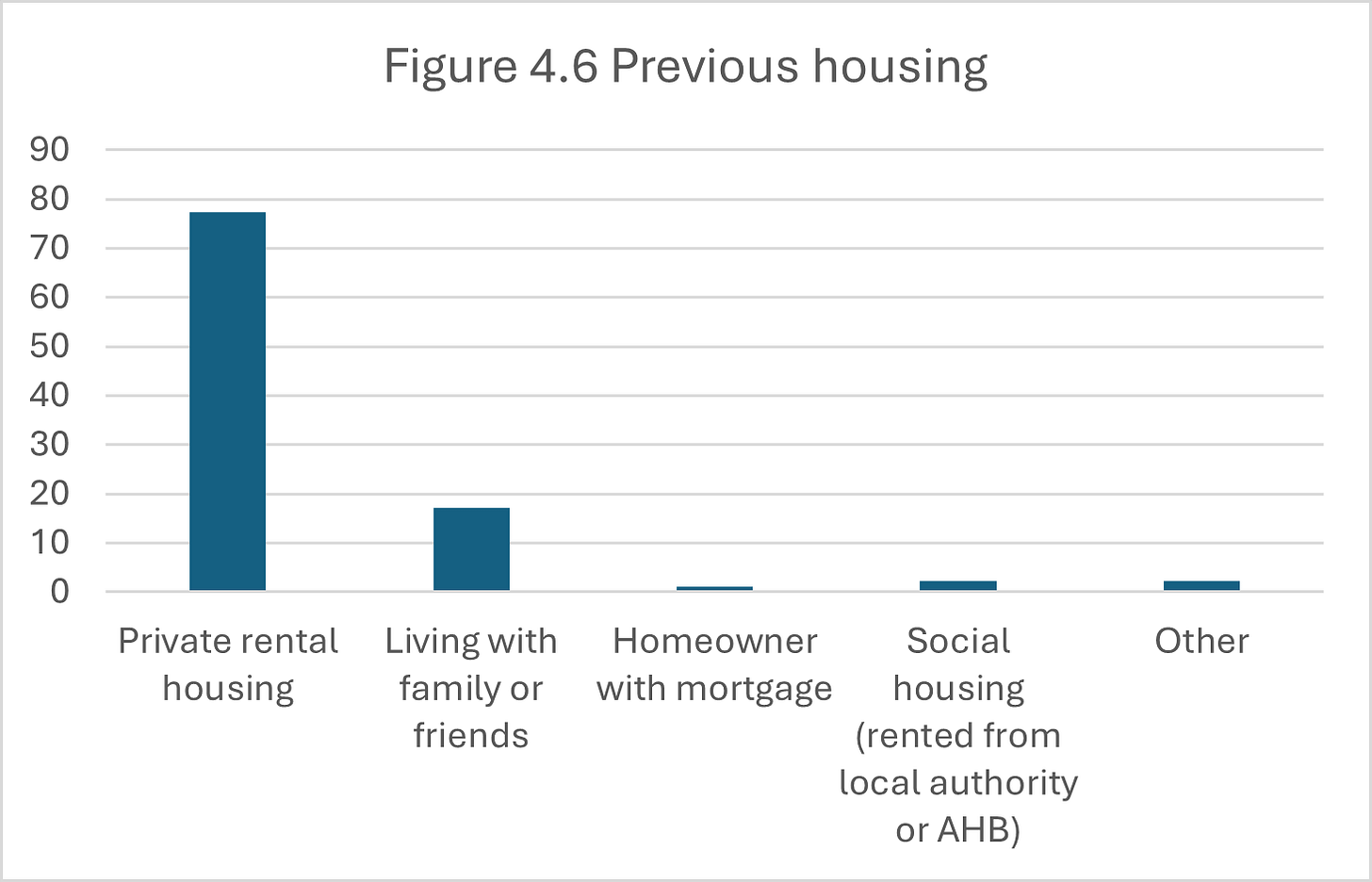

In terms of housing career, a large majority where previously living in the PRS, with a small group living with family/friends. The main reasons for leaving previous accommodation were that it was not suitable for the households needs, they couldn’t afford it, or they were asked to leave.

Generally, a lot of research participants described problems with their previous accommodation such as: too small, presence of damp/mould, unresponsive landlord etc. My overall impression, based mainly on the interviews I conducted, was that Cost Rental tenants are mainly long term renters who are sick to their back teeth of the problems in the PRS and wanted to move somewhere that’s decent quality, well managed and secure. Indeed, the survey found that needing a place to live, wanting a long-term home, and housing quality were the top three reasons given by respondents as to why they had applied.

In terms of future housing plans, the most common response was to remain in their Cost Rental home for the rest of this life. Here’s some quotes from the related open ended survey question:

We love where we live and hope to stay here forever more.

My rental is very comfortable and modern also I feel very secure and happy in my new home.

Feels comfortable at the moment, good space for a growing family.

Love the security and affordability.

The stability and security is very reassuring. The level of maintenance and the relationship with the landlord are very positive and professional. The physical environment is safe and well maintained.

However, a majority of survey respondents did express an aspiration for homeownership, here’s some quotes from the related open ended question:

I would like to step up the ladder and be a homeowner at some stage of my life.

I’ve always wanted to own my own home so if it’s something I can do I would buy a house and make my apartment available for someone that needs it.

Everyone dreams to have a forever house.

Our overall dream would be to own our own home.

Most tenants are in the middle of the income distribution (deciles 4 - 7). There are even some in the top 10%. These are presumably households without children, so that household income per person is elevated. There were no households in the bottom 10%, which is unsurprising given the minimum income threshold required to be eligible for Cost Rental housing.

Events & News

Simon Week is coming up at the end of the month, with events around the country - here’s the link to the Dublin stuff. A reminder that Focus Ireland’s conference on ending homelessness will be happening later in the month. The Business Post Property Summit will take place in November (I’ll be speaking at it).

What I’m reading

Sinn Féin’s housing plan. Threshold’s fascinating paper on the potential of the cost rental sector and its relationship to the PRS. A new Housing Agency data series on housing expenditure since 2011. Looking forward to checking out the new RTB individual property level analysis published yesterday.

This is the first I’m hearing of cost rental housing. I live in NY, wondering how that could happen here. Seems like it needs both a funding mechanism and an able and willing developer, both of which we lack currently. But we do have a state assembly member pushing for a new housing authority.