Private renters & the Housing Agency’s Residential Satisfaction report

The Week in Housing 31/06/24

Over the next few weeks I’ll be returning to a weekly format to bring you a series of fascinating guest posts. I’m delighted to kick off this series with a piece by Anne Murphy, Research Analyst at the Housing Agency. Anne is the author of one of the most important recent publications in terms of Irish housing: the National study of housing experiences, attitudes and aspirations in Ireland: residential satisfaction in Ireland 2023. Here she draws out seven key take ways from that report that shed light on the experiences of tenants and the comparative experience of different housing tenures in Ireland. Many thanks to Anne for this insightful piece. On another note, the recording of my #SimonTalks webinar earlier in the week, on the future of the PRS, can be watched here.

While overall households in Ireland are satisfied with their homes, as reported in The Housing Agency’s recent Residential Satisfaction in Ireland 2023 report, the below analysis shines a spotlight on the differing experiences of private renters compared to those of social renters and owners. It uses data from the the fourth wave of the National Study of Housing Experiences, Attitudes and Aspirations in Ireland. A key strength of the study is its design, which includes both renters and owners in its survey, so these tenure groups can be directly compared. In this respect, the findings presented here resonate with this recent The Week in Housing piece on Inequality and Home, and highlight the National Study’s utility in comparing groups, including by tenure.

The research was undertaken in 2023 via face-to-face interviews in householders’ homes conducted with a nationally representative sample of 1,212 people aged 18 and over.

Here are seven key takeaways.

1. Private renters have lower satisfaction levels than owners

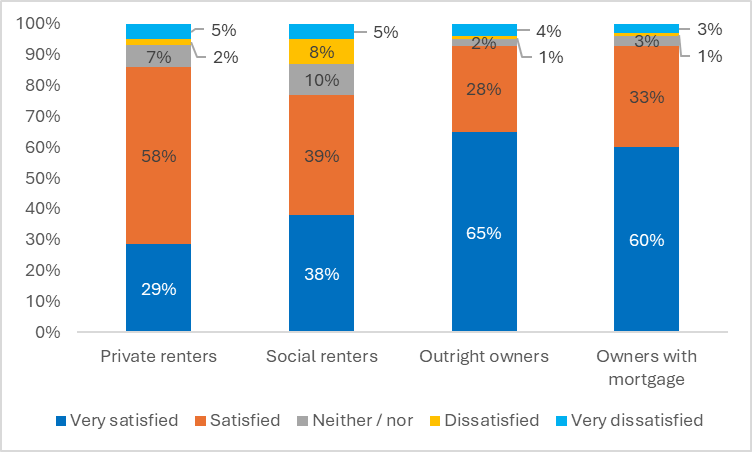

When asked about their satisfaction with their homes, 87% of private renters reported they were satisfied or very satisfied, a higher proportion than social renters (77%), but lower than 93% each of owners with a mortgage and outright owners. See figure 1.

Figure 1: Housing satisfaction by tenure (n = 1,118)

In relation to householders’ attitudes to living in their current homes, 52% of private renters stated they did not find it difficult to live in their home, compared to a similar proportion of social renters (54%), but lower than outright owners (74%) and owners with a mortgage (72%). Fewer than half of private renters (48%) and social renters (46%) felt their homes were suited to their needs, in contrast to 72% of outright owners and 74% of owners with a mortgage. Enjoyment of living in their current home was highest for owners with a mortgage (79%), compared to 52% of private renters.

2. Renters face more problems with their homes than owners

Renters overall reported a higher level of problems with every aspect of their dwelling compared to owners, except for their home being too big for their needs. Renters’ top three problems were firstly, keeping their home warm (34% of renters compared to 17% of owners); secondly, shortage of space (26% of renters compared to 12% of owners); and thirdly, difficulties with the cost of upkeep of the dwelling (25% of renters compared with 19% of owners). See figure 2.

Figure 2: Incidence of housing issues / problems by tenure (% ‘somewhat’ / ‘a big problem’) (n = 1,118)

3. Private renters have the lowest positivity about their experience of renting

When asked about their experience of renting, less than three-fifths of private renters (55%) stated their experience was positive or very positive, compared with nearly two-thirds of social renters (65%). However, similar proportions of private (13%) and social renters (12%) reported their experience of renting as negative or very negative. Owners likewise, were asked about their experience of homeownership. Differences emerged, with 95% of outright owners reporting high positivity compared to 87% of owners with a mortgage. For one in ten owners with a mortgage, their experience of homeownership was negative or very negative (11%), nearly three times the proportion of outright owners (4%). Both renter groups reported lower levels of positivity about their experience of renting than did owners about their experience of homeownership.

4. Private renters experience lower security of tenure compared to social renters

Private renters had lived in their current home for an average of four years, less than half as long as social renters, at an average of ten years. Private renters had been renting in total for an average of eight years, also half as long as social renters, who had been renting for 16 years on average (the average age of private renters in the sample was 35 years, while that of social renters was 43).

Less than two-thirds of private renters (63%) felt secure or very secure in their tenancy, compared to nearly four-fifths of social renters (78%). Conversely, nearly twice the proportion of private renters (15%) felt insecure or very insecure compared to social renters (9%). The survey did not ask owners about their perception of their security of tenure.

5. Private renters report high levels of perceived housing cost burden

Social renters reported the highest level of perceived housing cost burden (78%), with private renters reporting the second highest level (74%) of the four tenure groups. Outright owners reported the least (43%), compared to 63% of mortgaged owners.

6. Almost a third of renters have difficulty paying their monthly rent

Approximately one-third each of private (28%) and social renters (31%) experienced some or a lot of difficulty paying their monthly rent. Owners with a mortgage reported lower levels of difficulty paying the mortgage each month than did private and social renters in paying the rent, with 8% of mortgaged owners experiencing some or a lot of difficulty.

7. Over half of private renters intend to move in the next five years

Of the overall sample, 40% stated they were likely to move within five years. Private renters had the highest proportion (56%) of the tenure groups who intended to move within five years, almost three times the proportion of social renters who intended to move (20%), and the lowest proportion who intended to remain in place (20%). See figure 3.

Figure 3: Likelihood of moving within 5 years by tenure (n = 1,118)

Renters’ top reason for being likely to move was tenure related: 36% of private renters wanted to buy a home, while 28% of social renters wanted to rent (another) social housing property. Owners’ top reason for being likely to move concerned fit of the dwelling with household needs: nearly half of mortgaged owners wanted to buy a larger home (47%), while 29% of outright owners wanted to rightsize after raising a family. See figure 4.

Figure 4: Top 5 reasons for being likely to move by tenure (n = 488 - those ‘unsure’, ‘likely’ or ‘very likely’ to move)

Private renters differed from social renters in their future tenure aspirations, with three-fifths of private renters expecting to buy a property in the future (62%), whereas a similar proportion of social renters expected to always rent (59%). The study also found that less than a third of private renters (29%) would like to stay in their current neighbourhood long-term, compared with nearly half of social renters (46%), seven-tenths of owners with a mortgage (70%) and nearly four-fifths of outright owners (79%).

This piece uses descriptive statistics to provide a brief insight into private renters’ experiences and attitudes, and future housing aspirations compared to social renters, owners with a mortgage and outright owners. Future analyses will include testing for statistical significance in term of differences between groups and investigate the drivers of housing aspirations.

Events & News

The Housing Agency’s call for applications for the latest round of Research Support Programme funding has been announced. This year’s focus is on sustainable communities. Clúid Housing have opened applications for this year’s Simon Brooke award. On Monday, I presented a paper on my ‘vision for the Private Rental Sector’ (drawing on this post from a couple of months back). Thanks very much to the Simon Communities for the invitation to take part in their #SimonTalks series and to the audience members who posed some great questions. You can access the slides of my presentation here. Anyone interested in doing a PhD should check out this brilliant scholarship opportunity.

What I’m reading

In case you’ve been hiding under a rock, the report of the Housing Commission was published last week. I haven’t finished yet but it is certainly a landmark publication for the housing sector. Important new ESRI publication looks at impact of inadequate housing on children and family wellbeing.